santa clara county property tax due date

The Add-On Service Subscription Term is a continuous and non. Report a Possible Violation How to report a possible violation in the Unincorporated area of Santa Clara County.

The 20222023 Annual Secured tax bills will be available online beginning late-September 2022.

. All accrued sums on or before the payment due date for the accrued sums. Grant County Park and can request images from us. Print VitalCheks form and get it notarized.

Updated every Tuesday Friday excluding holidays. Due to the fact that Santa Clara County is home to several major hospitals there are in general more deaths that occur in the county than deaths of county residents. The County of Santa Clara provides retirement benefits to its long-term coded employees.

However they are required to report all outbreaks 3 or more cases as defined by CDPH within 48 hours through the Shared Portal for Outbreak Tracking. Property Tax Management System. If December 10 April 10 or August 31 fall on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

The property taxes you pay on a home are called secured taxes. The Clerk-Recorders birth certificate records extend back to 1873. You can also view artifacts from Martial Cottle County Park or Joseph D.

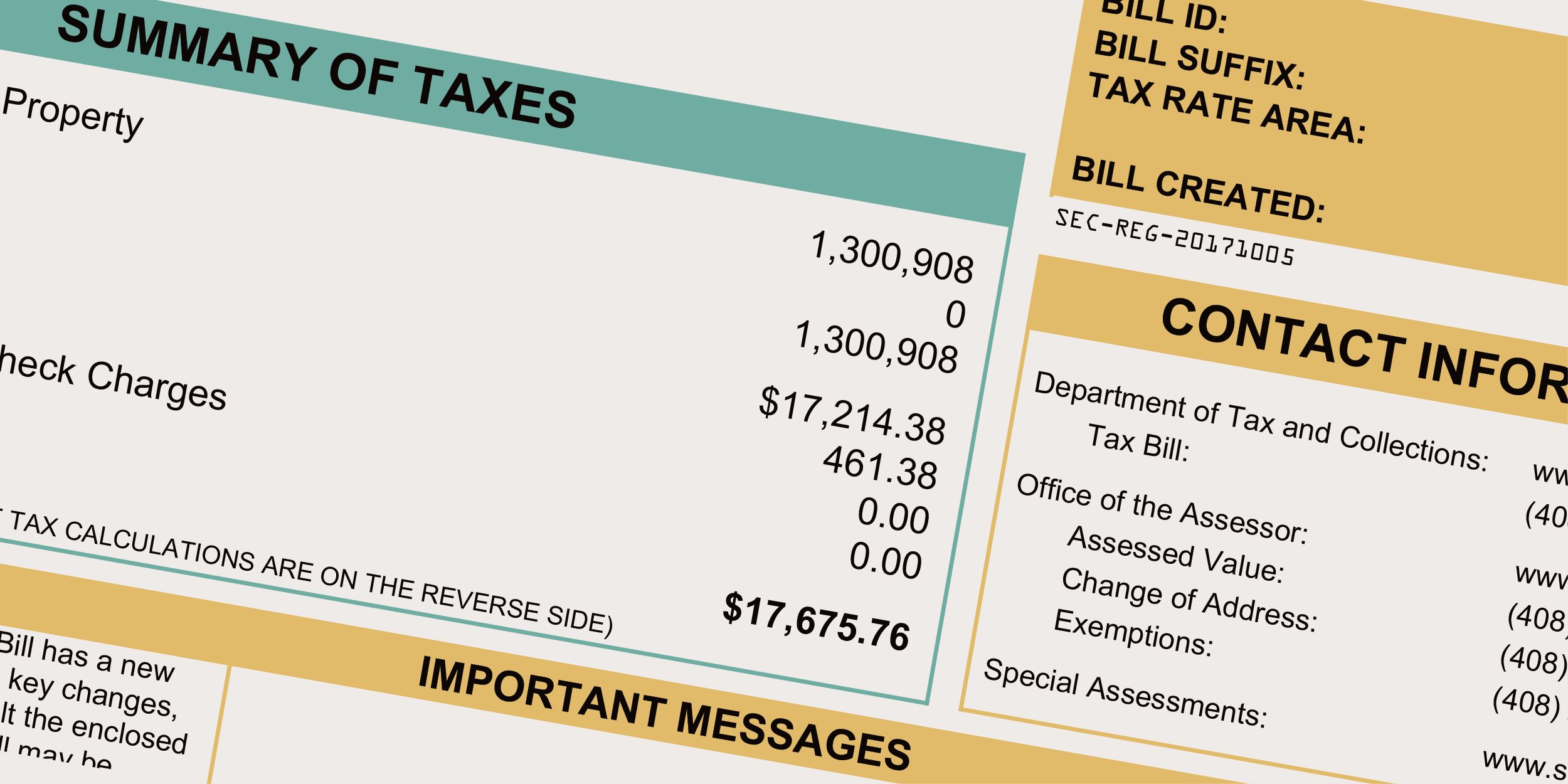

Additionally for eligible employees the County provides access. Submit your payment online. A search for a prior year already paid secured property tax bill will result in no record found.

Make sure you review your tax card and look at comparable homes. San Jose CA 95110 408 755-7130. Tax bills are mailed and due upon receipt.

The Santa Clara County Office of the Tax Collector collects approximately 4 billion in county city school district and special district property taxes each year. County of Santa Clara Government Center 70 West Hedding Street East Wing 8th Floor San Jose CA 95110 408 299-5830 ESA-HR at Santa Clara Valley Health and Hospital System 2325 Enborg Lane Suite 1H105 San Jose CA 95128 408 885-5450 408 885-5461 ESA-HR at Social Services Agency 333 W. You must provide your full name date of birth drivers license or ID number AND the date your ID or license was issued.

MPX Cases in Santa Clara County by Date. County of Santa Clara Announces Availability of Newly Approved Novavax COVID-19 Vaccine. Most businesses are no longer required by law to report individual cases of COVID-19.

Property Tax Payment History. Data as of September 15 2022. Use of condoms during sexual activity is recommended for 12 weeks after infection due to unknown risk of prolonged shedding in genital excretions.

Fax or email the notarized form to the Clerk-Recorders Office. County of Santa Clara. This list is subject to change.

New Horizons Affordable Housing Development a nonprofit affiliate to the Housing Authority of the County of Santa Cruz is soliciting for General Contracting Services for the constructions of Natural Bridges Apartments a 20-unit 3-story affordable housing property located in westside Santa Cruz at 415 Natural Bridges. Report Outbreaks to the Santa Clara County Public Health Department. SANTA MONICA DAILY PRESS.

Pediatric boosters are available for children 5 11 years old 5. The information provided will. Never miss another hot celeb story.

Property Tax Penalty Cancellation Form Mail Mail the form along with the required documentation to. The Add-On Service Subscription Term is a continuous and non. These benefits are determined by a combination of factors including age length of qualified service PERS member classification miscellaneous or safety and a contribution rate determined by bargaining unit agreem ents.

As of 61022 new case counts include cases that are presumed reinfections defined as a positive test more than 90 days after the first positive test for a previous infection. That the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two. Park trails are subject to closure due to poor conditions typically after heavy rains.

Develop or Improve a Property Rules and guidelines for developing or improving a property. Department of Tax and Collections Attn. Hedding Street San Jose California 95110 Phone.

County of Santa Clara Prepared to Begin Bivalent COVID-19 Boosters Once Supplies Arrive. No fees are required at any entrances. Tax Collections Unit 852 N 1st Street San Jose CA 95112.

Those counties accepting Proposition 90 are Alameda San Diego Santa Clara Los Angeles Orange San Mateo and Ventura. The Santa Clara County Clerk-Recorders Office Restrictive Covenant Modification Program and Implementation Plan may be found here. If you do not pay your unsecured tax bill by the due date a penalty of 10 will be charged on the date of the delinquency.

To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud. VitalChek is the only authorized online service for Santa Clara County death certificates. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property.

Please check with the local county assessor before purchasing a. August 31 Last day to pay unsecured taxes without penalties. To know if someones house or other real property is in a trust go to the County Clerk-Recorders Office or contact the Public Service Unit of the County Assessors Office at 408 299-5500.

Information about the childs parents. Make a Virtual Appointment or Inquiry Make an appointment for virtual consultation with a planner or development engineer. The County of Santa Clara Public Health Department recommends all eligible members of the public who live or work in Santa Clara County receive a COVID-19 booster shot.

County of Santa Clara. The juiciest celebrity news from all around the web on a single page. For More Information Please Contact County of Santa Clara Office of the Sheriff Custody Bureau 150 W.

To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud. All accrued sums on or before the payment due date for the accrued sums. The time date and location of birth.

The park is open year-round from 800 am. Beginning February 1 2022 the fees for real estate recordings will increase by 200 per title pursuant to Government Code 273882. Fill out VitalCheks online form.

Monday-Friday 8am-5pm 408 808-2804. The Clerk-Recorder maintains birth certificates for all the people born in the County of Santa Clara. It is not easy to trace the ownership of bank accounts brokerage accounts and personal property.

Open the form and read the information on the last page of. Property Tax Balance Due. May vary due to volume of requests To Do.

If you would like a copy of your 20212022 property tax record please visit our Contact Us page. Step by Step Instructions for Filling Out the Property Tax Penalty Cancellation Form.

Property Taxes Department Of Tax And Collections County Of Santa Clara

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Santa Clara County Property Taxes Due Date Ke Andrews

Santa Clara County Ca Property Tax Calculator Smartasset

Learn About Temporarily Lowering Your Tax Bill In Santa Clara County California Apartment Association

Property Tax Deadlines Andy Real Estate

Supes Say Santa Clara County Mental Health System Fundamentally Broken Local News Matters

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M